Building Self-confidence: Dependable Trust Foundations

Wiki Article

Strengthen Your Tradition With Specialist Trust Fund Structure Solutions

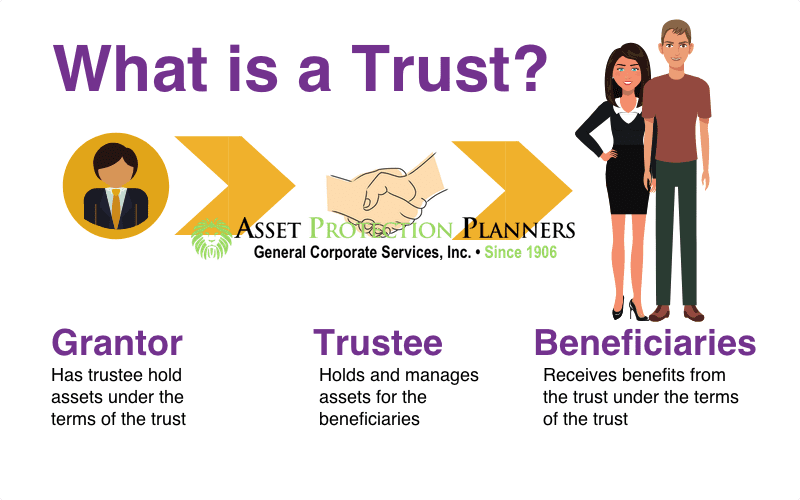

In the realm of tradition preparation, the relevance of developing a strong foundation can not be overemphasized. Specialist trust structure solutions use a durable framework that can safeguard your assets and guarantee your dreams are accomplished specifically as planned. From reducing tax obligation obligations to picking a trustee that can capably handle your affairs, there are vital factors to consider that demand interest. The complexities associated with trust structures require a critical method that aligns with your lasting goals and worths (trust foundations). As we delve right into the subtleties of count on foundation services, we uncover the crucial elements that can strengthen your heritage and provide an enduring influence for generations to find.Benefits of Trust Fund Foundation Solutions

Trust foundation remedies provide a durable framework for safeguarding possessions and guaranteeing long-term financial protection for people and companies alike. One of the main advantages of count on structure options is possession protection. By developing a trust, people can protect their properties from potential threats such as claims, lenders, or unanticipated financial commitments. This defense guarantees that the possessions held within the depend on stay safe and can be passed on to future generations according to the individual's desires.Through trust funds, people can detail just how their properties ought to be taken care of and dispersed upon their passing. Trusts also use privacy advantages, as possessions held within a trust fund are not subject to probate, which is a public and typically lengthy legal process.

Sorts Of Counts On for Tradition Planning

When thinking about heritage preparation, a vital element entails checking out numerous types of legal instruments made to protect and disperse properties efficiently. One typical kind of count on used in legacy planning is a revocable living trust fund. This trust fund enables people to preserve control over their properties throughout their lifetime while making certain a smooth shift of these possessions to beneficiaries upon their death, staying clear of the probate procedure and providing privacy to the family members.Another type is an irrevocable count on, which can not be altered or withdrawed as soon as developed. This trust offers potential tax obligation benefits and shields possessions from lenders. Charitable trust funds are additionally popular for people looking to support a cause while keeping a stream of earnings for themselves or their beneficiaries. Special requirements trust funds are important for individuals with disabilities to guarantee they obtain required care and support without endangering federal government benefits.

Recognizing the different types of trust funds readily available for heritage planning is critical in developing a detailed method that lines up with individual goals and concerns.

Picking the Right Trustee

In the realm of heritage preparation, an important facet that requires cautious factor to consider is the option of an appropriate person to fulfill the pivotal role of trustee. Choosing the best trustee is a decision that can considerably impact the successful implementation of a depend on and the fulfillment of the grantor's desires. When choosing a trustee, it is vital to prioritize top qualities such as credibility, economic acumen, stability, and a commitment to acting in the very best rate of interests of the recipients.Ideally, the chosen trustee must possess a solid understanding of monetary issues, can making sound investment decisions, and have the capacity to navigate complicated legal and tax needs. Furthermore, reliable interaction skills, focus to detail, and a readiness to act impartially are also crucial attributes for a trustee to have. It is suggested to select a person that is reputable, responsible, and with the ability of satisfying the responsibilities and obligations linked with the duty of trustee. By thoroughly thinking about these variables and choosing a trustee who lines up with the values and purposes of the trust, you can aid guarantee the long-term success and pop over here conservation of your see legacy.

Tax Obligation Effects and Benefits

Taking into consideration the monetary landscape surrounding count on structures and estate preparation, it is paramount to dive into the detailed world of tax effects and benefits - trust foundations. When developing a trust, recognizing the tax ramifications is essential for optimizing the benefits and reducing potential obligations. Depends on supply different tax obligation benefits relying on their structure and purpose, such as lowering estate tax obligations, earnings taxes, and gift taxes

One substantial advantage of specific trust frameworks is the ability to move assets to beneficiaries with minimized tax effects. Irreversible depends on can eliminate possessions from the grantor's estate, possibly lowering estate tax obligation liability. In addition, some trusts permit income to be dispersed to beneficiaries, who might remain in lower tax obligation brackets, causing overall tax cost savings for the family members.

Nonetheless, it is essential to note that tax regulations are complicated and conditional, stressing the requirement of seeking advice from tax obligation experts and estate preparation professionals to make sure conformity and make best use of the tax benefits of count on foundations. Appropriately navigating the tax ramifications of trusts can bring about significant cost savings and a much more efficient transfer of riches to future generations.

Steps to Developing a Count On

To establish a trust successfully, precise focus to detail and adherence to lawful methods are critical. The first step in developing a depend on is to clearly specify the objective of the trust and the assets that will certainly be included. This entails determining the beneficiaries that will certainly benefit from the trust fund and appointing a trustworthy trustee to take care of the properties. Next, it is crucial to choose the kind navigate to this site of depend on that ideal aligns with your goals, whether it be a revocable count on, irrevocable trust, or living trust fund.

Verdict

In final thought, establishing a trust foundation can provide various advantages for legacy planning, consisting of property defense, control over circulation, and tax benefits. By picking the proper sort of count on and trustee, people can secure their properties and ensure their desires are accomplished according to their needs. Understanding the tax effects and taking the required steps to establish a depend on can help strengthen your tradition for future generations.Report this wiki page